We’re getting deep into the weeds this week. We’re talking about private practice tax write-offs. No idea what I’m talking about? It may sound yawn-worthy at first, but tax-write offs are the best. A little knowledge about how to do things the right way will keep you from giving money to the IRS that you don’t actually owe!

Disclaimer: I am not a trained tax professional. Be sure to hire an accountant to consult when you’re getting started. But this info should help you have a sense of what’s going on before you dive in with a professional.

What are Tax Write-Offs?

First of all, when you run your own business, the IRS lets you write off the majority of your expenses. This means that you get to deduct your expenses from your income, and primarily pay taxes on what’s left.

This is amazing!

Many of you are likely not aware of this benefit and are paying money to the IRS that you don’t owe them. Let me help you change that!

Using the Schedule C 1040 for private practice tax write-offs

If you’re operating as a sole proprietor or a single-member LLC, you file a tax form called a Schedule C 1040.

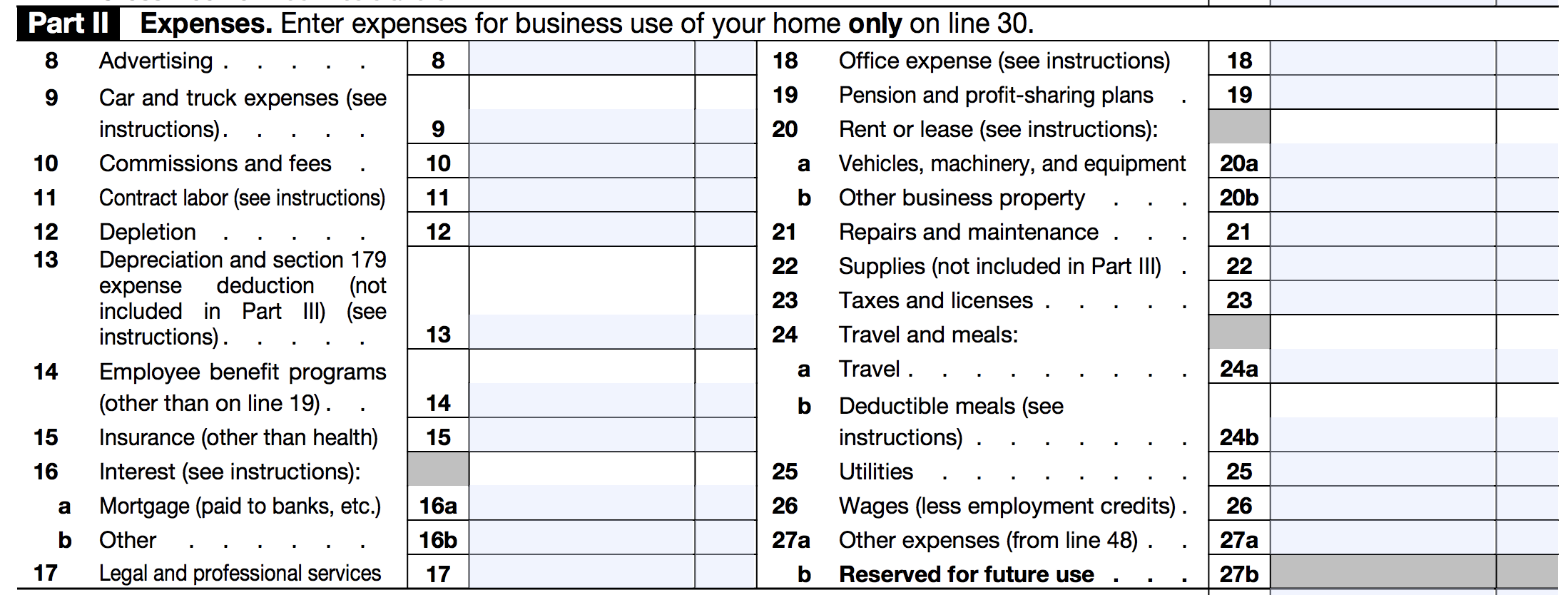

It’s not super complicated to complete. However, in Part II: Expenses there’s a long list of items that you have to break down your write-offs under:

When I first saw this list I was completely overwhelmed. I had no idea what expenses I could count, let alone which tax-deductible expense category to list each item in. It can feel like a jumble!

Categories of Private Practice Tax Write-Offs

As it turns out, it’s not too complicated to fill out this form. Let me break down some of the more common private practice tax write-offs, especially if you’re first starting out.

I created a handy-dandy PDF showing the expenses and what category to list them under. Grab your free list of private practice tax write-offs here. If you have any expenses not listed on the form, be sure to check with the IRS about deductions.

Let’s go through each of these common categories of tax write-offs:

Advertising

Advertising includes expenses related to print or online ads, business cards, brochures, online directories (Like Psychology Today or TherapyDen), paid online search, Adwords, and any signage (like if you have a sign out front advertising your business).

Rent Payments

Rent is a big one for me because I live in a really expensive place and this is my biggest expense. Good thing we can deduct that!

Utilities

Utilities primarily reflects your electric bill and your business phone line – whether it’s a cell phone or a landline.

Insurance (other than health insurance)

This category reflects your liability insurance and malpractice insurance. This isn’t the category where you list your health insurance (more on that later).

Taxes and Licenses

This category includes the money you pay to have a city business license and the renewal fee of your psychologist license, MFT license, or whatever licensure you have. You can only write off your licensure fee for renewals – you can’t write this off the very first time you ever become licensed.

Supplies (Tangible Office Supplies)

It’s really easy to confuse this category with the next one called “office expenses”. The best way to differentiate the two is that “supplies” refers to tangible office expenses, while “office expenses” refers to non-tangible office expenses.

Here are some examples of items you can write off in the “supplies” category:

- Cleaning supplies

- Postage

- Pens, paper, stapler, clipboard, etc.

- Books & magazines in the waiting room

- File cabinet and any affiliated filing supplies

- Printed paperwork

- Printer ink

- Smaller furniture pieces (under $2,500 – more on this later)

Office Expenses

These are all the intangible office supplies. Here are some examples of write-offs that go in this category:

- Website expenses

- Internet hosting fees

- Domain name payments

- Web software (e.g., Quickbooks, teletherapy service, EHR software, Dropbox)

Typically, most of the items in this category relevant to private practice are online.

Travel and Meals

I love this category because I try to allow myself to go on business-related travel at least once a year to attend things like continuing education conferences. Here are some items included in this category:

- Mileage

- Parking meters for off-site business-related meetings (be sure to log your mileage and what those meetings are for)

- Travel costs for continuing ed conferences or other business-related travel

- Meals while on business travels

- Meals for business-related meetings (like consulting with a colleague over lunch)

Other Expenses (Line 48 of Schedule C Form)

This is sort of a catch-all category. There are quite a few things you can include here! Though because it is rather miscellaneous, it’s not always completely clear what you’re allowed to write-off in this category. Here are a couple of the more common private practice items that fall in this category:

- Membership fees (e.g., APA or other affiliations)

- Credit card processing fees

- Bank fees (checking account fees, loan interest)

- Continuing education

Employee Benefit Programs

This category primarily refers to health insurance and retirement plan benefits.

There are some stipulations about who can deduct their health insurance or not, and it’s way too much to get into in this article. To learn more, check out this article from TurboTax:

Deducting Health Insurance Premiums If You’re Self-Employed

Depreciable Assets

This is kind of a funky category. I admit that I still don’t fully understand it, but in summary, it refers to office supplies, expenses, or equipment that you spent over $2,500 for.

As an example, let’s say you get a really nice laptop or a really nice piece of furniture for your business that cost $2,600. This is called a depreciable expense and it goes in this category once an item costs over $2500.

It’s a bit too complicated to elaborate on it here, but this forum sums up the purpose of this category well:

Keep in mind that this is a cursory list covering the majority of relevant write-offs if you’re just getting started in private practice. If you incorporate additional factors into your practice such as employees, contract work, etc., then it’s important to seek the advice of a tax professional to report those items properly.

If you have any expenses that I haven’t talked about here, check with the IRS to see if you can deduct them and to find out what category they’re in. The IRS has incredibly detailed instructions for how to fill out the Schedule C Form:

IRS Instructions for Schedule C

How to Keep Track of Private Practice Tax Write-Offs

You might be wondering: how do I keep track of all of these private practice write-offs? An easy place to start is having a separate checking account for all your business expenses. You can learn about the advantages of having a separate checking account in my article Bookkeeping for Private Practice: Business Checking Account.

Personally, I put all business-related expenses in a separate account and keep all of my receipts. At the end of every month, I run through each expense and categorize them in a Google Sheet along with all of my profits. You can also pay for a program like Quickbooks to help you do this easily.

As I go through the year, I continue to tally all of my write-offs so that come tax time I know what my adjusted gross income is that I need to pay taxes on. Keep in mind that we owe our taxes quarterly in small business.

I hope this article helps you wrap your head around private practice tax write-offs. Feel free to download the free PDF for your own review. Until next time, from one therapist to another: I wish you well!

-Marie

Photo by Leone Venter on Unsplash

Leave A Reply